How to make your EB management more efficient: our top tips

Managing your insurable Employee Benefits requires a strategic approach for maximum efficiency.

Not only will a calculated method to management help your team to better coordinate Employee Benefits, but you’re able to more effectively market benefits to your employees and streamline budgets required to facilitate these benefits.

Learn more about how to optimize your system of EB management for efficiency with our top tips below.

Align your Employee Benefits packages

Creating, implementing and executing your proposed Employee Benefits packages means finding the right providers, no matter where your employees will be located.

Working with a broker or a tool that can accurately align your Employee Benefits with your employee expectations, your assigned budget, your company culture and more is key for success and efficiency.

Paying for company group health insurance that won’t cover the majority of your employees’ needs, for example, is a sure-fire way to ensure your employees won’t feel connected or satisfied with your business - and will cost you more money for coverage in the long run.

Our tips for aligning your Employee Benefits packages:

- Understand how you plan to use Employee Benefits: Will these benefits aid with recruitment, help to retain employees, or reward employees for great service?

- Understand your employees’ needs: What do your employees want from their insurable Employee Benefits?

- Use adequate packages: Will your insurable Employee Benefits provide sufficient health insurance for employees in each location? What regional differences might there be in coverage required?

Offer variety, but make it manageable

Employee Benefits need to be useful enough to attract new employees and reward current staff, but often businesses can find themselves with an unmanageable workload when it comes to handling insurable Employee Benefits.

However, particularly after the global pandemic and the Great Resignation, companies are having to offer better benefits to lure potential employees to their service.

For example, comprehensive health insurance for company employees is now of significant importance for jobseekers. Your potential employees are looking for the best mix of salary and high-quality insurable Employee Benefits - are you offering what they’re looking for?

Up to 50% of US residents alone use employer health insurance, and the global health insurance market is predicted to grow 5.5% (compound annual growth rate) until 2028, meaning competition will only grow more fierce to meet employee needs.

But how do you create varied benefits for your employees and remain competitive while also ensuring your team and your budget aren’t overwhelmed? Our top tips:

-

Source the best Employee Benefits: Creating a benefits package that can tempt new employees or encourage current staff to remain requires large-scale benefits that stand out. Research and implement the most attractive benefits for your particular employee demographic for the best results.

-

Make your teams’ lives easier: Relying on individual teams in your company network to source, manage and market your insurable Employee Benefits and all the global data that requires may be asking too much. Streamline their work by using sophisticated tools, advisory and automation to reduce strain.

Communicate clearly to your employees

It’s not only your team that can become overwhelmed by trying to manage Employee Benefits. Your employees themselves can often find occupational pension and other benefits confusing to understand and use. If your employees can’t figure out how benefits work for them, they’re soon going to stop seeing them as a deciding factor in choosing to work for your company.

Making sure your communication strategy includes clear, easily digested information on what Employee Benefits mean for those working for your business is key for employee retention.

Our best tips:

-

“Translate” your information: The details you provide to help your employees figure out what corporate medical insurance, travel insurance and more means personally to them are important. Make sure they’re written in terms your employees will understand.

-

Use an Employee Benefit consultant or tool to handle employee needs: Rather than having to deliver complex information directly to your employees, use a third party medium to get data across effectively in a way your employees will respond to.

Use effective tools

Particularly for larger businesses working across multiple regions, managing corporate group health insurance, travel insurance, pensions and more can become complex very quickly. With complex data and personal details in the mix, keeping detailed records and collating all relevant information in one place can be the difference between an efficient system and overwhelming your team.

Using a sophisticated solution to handle your Employee Benefits under one umbrella can greatly reduce strain on your team, and subsequently your budget. Our top tips:

-

Bring disparate systems under one solution: The less manual processes that are needed to manage Employee Benefits, the more time can be spent on making your system more financially efficient. Use one centralized tool that can cover all your needs.

-

Use a tool that can easily display data and insights: Using an Employee Benefits management tool that can show you at a glance all the reporting data you need and the insights that are vital to you will significantly reduce staff burden.

How ASN-WEB can make your Employee Benefits management more efficient

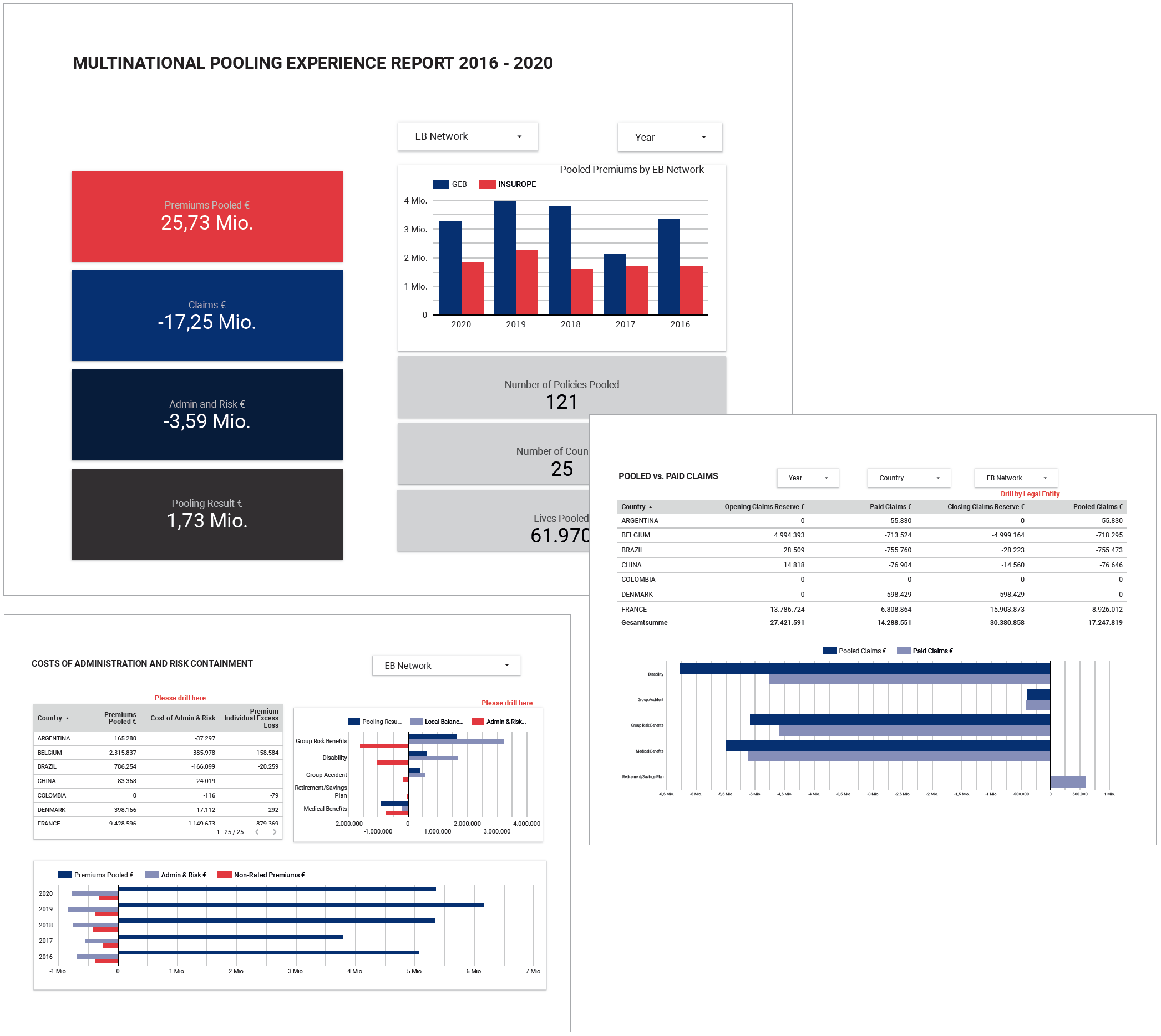

The ASN-WEB EB Dashboard acts as an Employee Benefits consultant and administrator all in one.

Rather than using a variety of systems to manage the complexities of providing insurable Employee Benefits across the globe, our tried-and-tested Software as a Service (SaaS) solution reduces the impact on your team members, sources appropriate insurance options and reduces costs.

We’ve based our user-friendly platform on our decades of experience in providing Employee Benefits consultancy to medium-size to large-scale multinationals across the world. This means you not only enjoy world-class technical and security standards, but we give you access to the best Employee Benefits schemes available.

We’ve developed connections to a trusted partner network in over 40 countries, allowing us to create and manage all (virtual) multinational pools for you. We do the hard work, and then present you with the important details on one comprehensive dashboard - meaning your team can focus on what’s most important to you.

We offer you:

-

Greater control over the costs of your Employee Benefits plans

-

Reduced difficulty and complexity in your Employee Benefits plan management

- Consistent and comparable reporting across your insurable Employee Benefits

- Multinational pooling, no matter your company size, handled with ease

- Great connections to reputable insurance providers

We’ve built in transparent, consistent reporting, with automatic monitoring and secure storage for all your documents, financials and more. ASN-WEB EB Dashboard makes your Employee Benefits management much more efficient and easy - why not get in touch now to find out how?