Gaining control over Employee Benefits: Yes you can!

Employee Benefits challenges for Mid-Size Companies: Focus on the DACH Region. Talent management. Employee health and safety. Fair compensation and benefits.Across the landscape of Human Capital Management, the past couple of years have brought tremendous changes—and with them, an urgent need for mid-size companies to modify their EB practices.

HR managers know that the old ways of doing business no longer fit today’s global talent marketplace. The dearth of younger workers means businesses must retain older employees longer. Benefit plans must cover the large and growing gap between the expectations of the older generation and the Gens X and Y. In a Covid-19 world, employees want and need more benefits focused on well-being and mental health. And in many countries, the definition of “fair” compensation (be that equal pay for women or minimum wage) and benefits like social security and pension contributions has been steadily rising.

Today’s employers must show they care by controlling their employees’ risk of injury and poor health—and laying out concrete goals and measures in an Employer’s Policy of Corporate Health.

For companies that have incorporated new subsidiaries in several countries through mergers and acquisitions, the challenges become very similar to those faced by large multinationals. And so do the responsibility and priority of the Board of Directors to manage the benefits landscape.

Because EB has traditionally taken a local perspective, most medium-size companies have not yet begun to tackle the necessary changes in benefits. Consulting with EB experts can help companies maintain control over the process of introducing new benefits and adapting existing ones. And it is imperative when companies decide to take a more decentralized approach.

Things are even more complicated in DACH companies, where global HR departments still handle talent acquisition, on-boarding, mobility management and EB management largely by hand. When asked for EB documents, many still respond with, “I don’t know where to find it right now.”

HR managers are frustrated by having to make decisions without the data they need to be truly informed. They feel powerless against insurers, brokers and local decision makers, and overwhelmed by the complexity of demands and regulations that reach their desks every day.

In theory, it should be so easy to automate EB management. But the reality is that only a few good systems exist, and they are not easy to implement.

That’s why ASN has created all the necessary tools to provide the solutions you need. As a medium-size and privately owned company in Switzerland, ASN understands the specific needs of mid-size companies in the DACH region (Germany, Austria and Switzerland) that are taking their first steps into international terrain, often under the ownership of their founding family.

Undeniably, some aspects of international employee benefits are quite technical. Therefore, the following chapters may be somewhat more austere than the introductory section. However, we are confident that anyone who works in an international HR department and faces challenges related to international benefits will find them very relevant and timely.

The ASN Team and Solutions

Founded in 1991 in Zurich, Advisory Services Network AG (ASN) is an international insurance specialist and employee benefits broker and consultancy. We are privately owned, with a corporate ethic that emphasizes trust, dedication, knowledge, and a welcoming spirit.

In addition to being a market leader in the field of international private medical insurance, ASN offers comprehensive and unique benefits solutions, including ASN-WEB (Worldwide Employee Benefits). In partnership with other top-tier service providers, such as insurance brokers and external benefits administrators, we support our clients’ efforts to establish transparency and control through consistent management services at the central and the local levels.

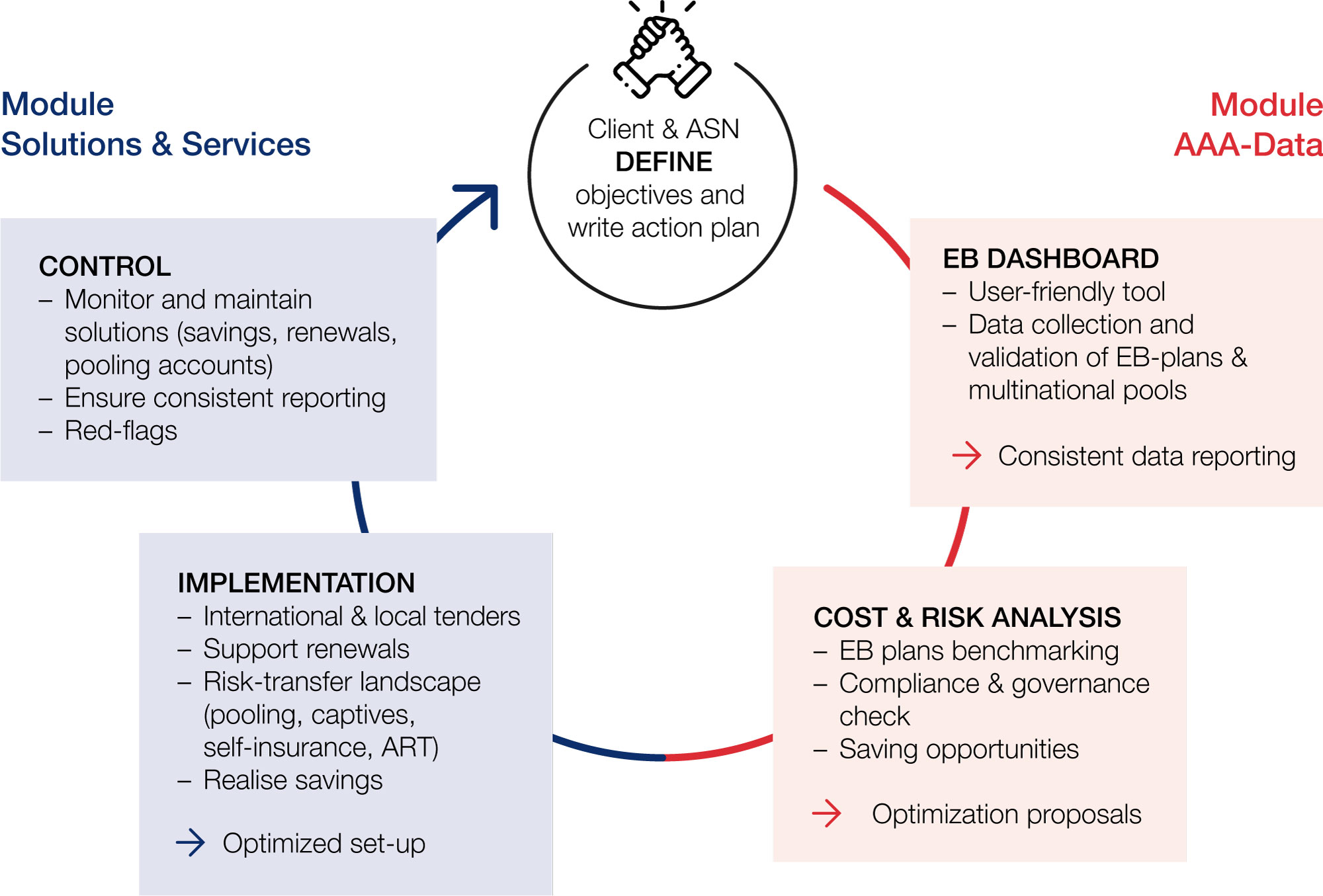

Our clients prefer a decentralized management approach, so ASN has developed the ASN-WEB modular proposition. It’s a strategic and fundamental approach to EB management.

ASN-WEB gives you all the resources you need to control the costs and risks of your global insurable benefits, with little effort required on your part.

Identifying Cost Drivers and Ensuring Compliance

Effectively managing insurable benefits requires a precise view of the benefits you offer in each country: what you provide, at what cost, and for what reason. Without this comprehensive view you risk:

- Not being able to control compliance and the governance of risks and costs.

- Inaccurate reporting on benefits contents, financing, and compliance.

- Lack of focus on the relevant information for intelligent decision-making.

- Insufficient data for negotiating the price of services being purchased.

And most importantly… - The company does not deliver the level of benefits across all subsidiaries and countries that C-level management requires.

ASN‘s modular tools deal with all issues HR and Risk Managers face related to worldwide benefits, empowering you to:

- Identify the main cost drivers.

- Ensure compliance and governance.

- Help local HR and Finance teams deal with the increasing complexity and multifaceted demands of their employees.

ASN solves likely challenges around Employee Benefits Management, with a particular focus on controlling features.

With the AAA-Data module (AAA stands for Acquisition, Aggregation, and Analysis), ASN’s experts collect and catalogue all pertinent data about benefits being offered to employees through an online tool designed specifically for EB data management.

Then we analyze the underlying insurable risk, using actuarial methods such as claims projections, to uncover any potential for optimizing the costs of administering the plans and of risk transfer.

We understand that an employer must provide employees with a level of protection from financial harm should certain events occur. To that end, the ASN system routinely produces detailed reports and specific recommendations for each benefits plan. The exclusive aggregated EB dashboard tool, which you can use on an SAAS basis, also provides compliance and governance information, country profiles and benchmarks, updates on developments related to benefits, and alerts on missed renewal opportunities and costly set-ups.

Coordinating Solutions Internationally

The ASN-WEB Solutions & Services Module offers advice and support to help you implement the appropriate solutions, very often in close cooperation with existing insurance brokers.

ASN’s advice is based on the data acquired in the ASN AAA-Data module, using internationally backed solutions that are not usually available in local markets, so you can put a well-conceived and managed international strategy (that might include tapping into international insurance markets, multinational pooling, and other cross-country agreements, for example) into play.

The job performed by the service providers and ASN is carried out within ASN-WEB Partners, ensuring that you have access to the specialized knowledge and services of independent experts around the world.

Expert Insight #1: A Global Approach

Here’s an insight from Oliver Goede, showcasing why ASN's internationally driven approach is considered "best practice":

“Some years ago, I was responsible for Insurance and Risk Management at an industrial group that had more than 100 subsidiaries spread over 40 countries. Its benefits-related insurance contracts had grown, almost undetected, to a significant and non-controlled cost and risk factor.

Decisions about contents of the benefits plans and choice of servicing providers were fully delegated to local HR and Finance teams. At HQ level, there was no specific controlling in place.

Spearheaded by the Insurance Team, supported by the Board and in cooperation with HR and purchasing departments, the Group decided to run a project aimed at creating transparency and optimizing cost. The results were astonishingly good: We gained full transparency and counted savings scratching at the double-digit million euro mark within three years.

We also were able to ensure a sustainable cost control through internationally purchased policies and a successful multinational pooling Management optimized across different pooling networks.

During the project, many glitches in insurance cover that could not be solved locally became evident.

In the UK, for example, we had many legal entities employing personnel working onshore as well as on offshore platforms, and we had had to cope with a disparity of treatment between the two personnel groups for years before the project. The local HR teams had turned to different specialized brokers to set up at least a reasonable cover for the offshore personnel, which still was with limitations and exclusions. The combination of life and non-life insurance contracts, plus several carriers and brokers, made the system both cumbersome and extremely expensive.

The work of the international project team eventually led to a rather unique arrangement including cover with the insurer of choice and part of one of the Multinational Pools. All employees finally enjoyed benefits under the same conditions, with no disparity between onshore and offshore personnel.

In addition, annual management reports and access to valuable data through the multinational pooling agreement are now available at HQ level.

Ensuring Duty of Care through Controlled Outsourcing

In most medium-size companies, benefits functions are almost exclusively designated to local HR managers; there is almost no in-house knowledge about benefits at the head-office level.

Nevertheless, it is common practice to control the benefits for the expats employed by the HQ and other groups of employees who travel frequently. These are groups of employees for whom the issue of duty of care is particularly important, due quite often to different legislations.

Providing EB in this case might require several providers, insurance carriers, fronting companies, TPAs, etc. The HR function at the headquarters level must coordinate with local managers and keep close control of the benefits set-up.

Expert Insight #2: Rolls-Royce Power Systems (RRPS) Case Study

At Rolls-Royce Power Systems (RRPS) in Friedrichshafen, Germany, Andreas Klapproth years ago found the right benchmark for the right EB solution.

RRPS is part of the worldwide Rolls-Royce Group, but it operates independently with regard to specific local EB solutions for its 8,000 employees. Here’s its story:

At Rolls-Royce Power Systems, the category of mobile employees includes many different types of people who are employed by different companies and seconded to many different countries.

Some of these employees work on short- to mid-term assignments; some follow projects in different parts of the world with an open-ended contract; a few are what one would call “conventional” expatriates.

We want all these employees and their families to be treated fairly in terms of health insurance. We also strictly follow our organization’s compliance and governance guidelines in each country of destination.

No single insurance contract meets the required level of service and scope of benefits at all locations. Therefore, employers like us follow an internationally coordinated approach. We must make sure that there is worldwide portability and a secured way to return to the home country after a long stay abroad, without running the risk of being penalized for medical conditions acquired while on assignment.

We want to make sure this mobile form of workforce and their families have access to one unified first-level contact that delivers a predefined service level in terms of answering questions related to insurance cover and any medically related queries.

A center of expertise—at which our insurance contracts are managed and monitored, and where management reports are routinely produced—helps us, as an employer with a small insurance management team, meet our goals and comply with our duty of care.

In short, Klapproth has found it advantageous for multinational companies to use the type of services as offered by ASN in the module Solutions & Services, within the ASN-WEB Package. International brokerage services are provided via the company’s competence center in Zurich, as well as through local brokerage services offered by ASN-WEB Partners. The “Automatic Monitoring” tool set, utilizing the aggregated EB dashboard, provides contract management and monitoring to complement management support and reporting (local and HQ), as well as a dedicated multilingual service for insured employees and the RRPS plan administrator.

Virtual Pooling

The final step in the ASN-WEB approach is the implementation of the Virtual Pooling tool set.

Virtual Pooling gives our clients with 1,000 employees or more access to multinational pooling, using a single specific Employee Benefits Network, without your having to create and maintain your own multinational pool. You gain all the benefits of multinational pooling – the kinds of solutions and strategies that are normally available only to large, centralized multinationals -- without having to change your current insurance policies or service providers.

ASN helps you perform all the functions necessary in a streamlined and highly effective way. We help you choose the best pooling strategy—and then enact it for you, managing all the relationships involved (including employee benefits networks, insurers, and re-insurers).

Via the aggregated EB dashboard, ASN also provides sophisticated pooling monitoring that ensures the best possible service level for all pooled insurance policies, and aggregated management reports so you always know the details.

To show you just how powerful the system is, here are some examples from subsidiaries in two European countries.

Expert Insight #3: Ron van Overhagen on Dutch Pensions and Benefits

In the Netherlands, insured pension plans can be included in multinational pooling. Here is what the Dutch Pension and Benefits expert Ron van Overhagen has to say:

The effort of shifting from the historical Defined Benefits (DB) plans to more modern and affordable Defined Contribution (DC) plans has been the focus of HR managers in The Netherlands for the past 10 or so years. Now, with such change becoming a widely spread reality, it is necessary to verify how the new pension plans will benefit from multinational pooling.

What are the main differences in pooling of DB and DC plans?

For DB plans, the totality of the contributions to the pension plan (savings and risk premiums) participates in the multinational pool. This creates high volumes of premiums pooled.

For DC plans, only the risk part is pooled.

But while the high volumes of premiums pooled for the DB plans might look impressive, under the perspective of optimizing costs, multinational pooling is an attractive and meaningful tool for all types of pension plans. This is because international dividends deriving from pooling risk premiums can be as attractive as—or even higher than—those deriving from pooling premiums for retirement and risk together.

As a rough example, if we were considering a pension plan with total annual premiums (risk + savings) of 1 million euro, the pooling dividends deriving from a local technical result of a DB plan that ranges between 2.5% and 3% of total premiums would amount to between 25,000 and 30,000 euro.

In a DC plan with the exact same level of total annual premiums, the pooled risk premiums would amount to 100,000 to 120,000 euro (depending on the age structure of the insured employees), and the pooling dividends deriving from the pooling exercise could reach 35% to 40% of pooled premiums, i.e., from 35,000 to almost 50,000 euro.

For the sake of good order, I’ll note that a four-year transition period, in which all remaining DB plans in the Netherlands will be transferred to DC plans, begins on January 1, 2023. Therefore, now is the right time to verify the advantages of multinational pooling for the new DC pension plans. It is worthwhile for each employer to investigate the exact figures for its individual pension plan. As the risk premium is fully paid by the employer, the pooling dividends also will fully benefit the company.

Pooling will not just save employers money. Multinational pooling makes an overview of the claims experience within the pension plan visible, through regular reports that are otherwise not available.

These reports give insights into:

- The development of the risks insured.

- The trend of the rising costs of disability.

- The effectiveness of the case management related to the disability cover.

For any benefits under the BVG law in Switzerland, or the pension system in the Netherlands, ASN Virtual Pooling is a must. Expectations of experience-related profit sharing from the Global Network are high and proven in the long term. The legal basis for participation of these pension plans in pooling set-ups is given.

Conclusion

Even for mid-sized companies, optimizing the price and processes related to insurable Employee Benefits can have a big impact on the bottom line. But cost considerations and the lack of available talent often mean that hiring a full-time in-house specialist is not an option. Neither is quickly training a member of the existing HR team.

Employee benefits specialists have the expertise and experience that medium-size companies need. Their support brings the transparency and control that generate continuous improvements for both employers and employees, including financial savings, added security, geographical understanding, better inception conditions, and improved benefits offerings.

It’s time your company started down the path toward a less complicated and more successful future.